Cash Flow Chronicles: The Power of Effective Invoicing (InvoiceNow)

What precedes getting paid? The submission of invoice.

We all know this to be true- cash flow is the lifeblood of businesses. It’s the foundation that enables you to cover financial obligations promptly, from inventory purchases, loans, vendor payments and staff salaries etc.

However, if your traditional invoicing method has gaps or inefficiencies, it can negatively impact your cash flow leading to challenges managing business expenses.

A way to fulfill these invoicing challenges is e-invoicing, specifically through solutions like InvoiceNow. By embracing digital invoicing technology, you can revolutionize your invoicing process and unlock numerous benefits for your business.

Image 1.0- SME Go Digital Vendor Briefing (SGTech 2023)

What is Invoice Now?

InvoiceNow, or previously known as Peppol Invoicing, offers a streamlined and efficient way to send, receive and manage invoices electronically (IMDA 2023). This digital transformation enhances speed and accuracy of invoicing, but also facilitates seamless payment transactions.

TL;DR: The importance of e-invoicing helps your business improve cash flow, reduce errors and disputes, enhance customer relationships and gain competitive leverage.

If you’re ready to move forward from traditional invoicing’s limitations, continue reading to discover the benefits and solutions InvoiceNow will provide to your business!

Traditional Invoicing vs E-Invoicing

Traditional invoicing:Traditional paper-based process of creating physical invoices, printing them, and sending them via mail or hand delivery.

E-invoicing (electronic invoicing): Digital method of creating, sending, receiving, and processing invoices.

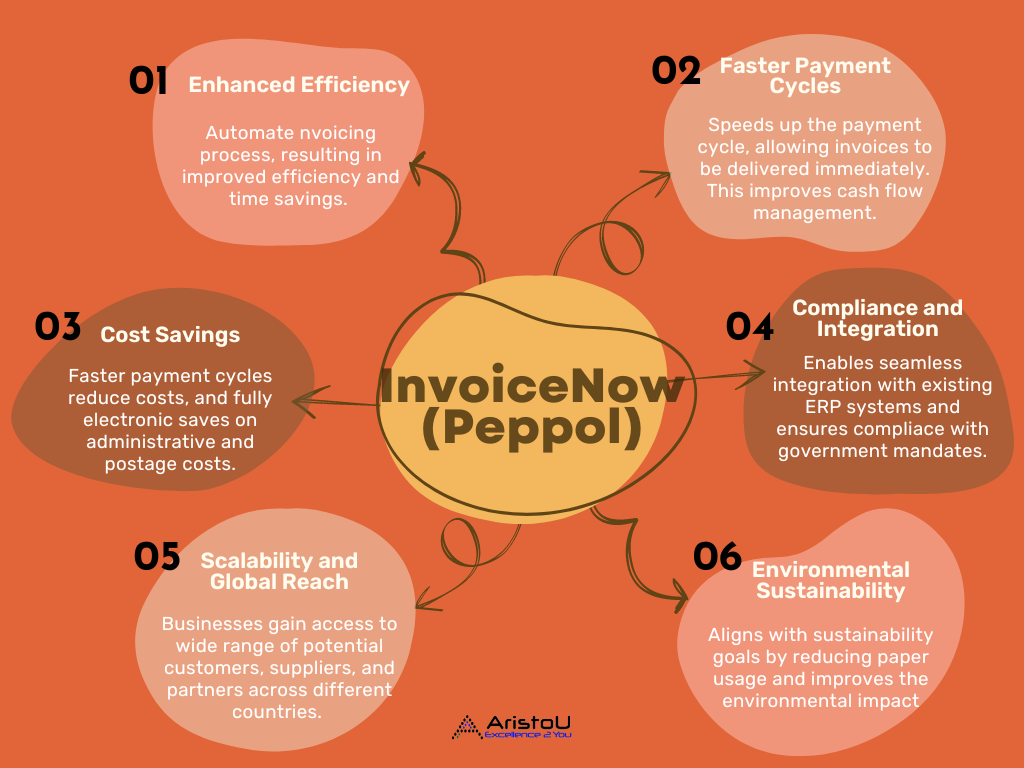

6 Benefits of switching to InvoiceNow (Peppol E-invoicing)

Besides the many advantages e-invoicing offers in terms of speed, accuracy, efficiency, and cost savings, here are 6 more incredible benefits of InvoiceNow:

1) Enhanced Efficiency

-

InvoiceNow enables SMEs to automate their invoicing processes, resulting in improved efficiency and time savings.

-

InvoiceNow provides direct transmission of invoices from the sender’s system to the recipient’s system. This eliminates the need for manual handling, data entry, and document conversion.

2) Faster Payment Cycles

-

InvoiceNow speeds up the payment cycle by allowing invoices to be delivered immediately and directly to recipients.

-

The efficiency and accuracy of the system contribute to faster invoice processing, enabling SMEs to improve their cash flow management.

3) Cost Savings:

-

By reducing manual tasks, paperwork, and the need for physical mail, SMEs can save on administrative and postage costs.

-

Additionally, the faster invoice processing and improved cash flow can have a positive impact on overall financial operations.

4) Compliance and Integration:

-

InvoiceNow is designed to meet regulatory requirements and industry standards. This means SMEs can ensure compliance with e-invoicing mandates set by governments or business partners.

-

Furthermore, InvoiceNow enables seamless integration with existing accounting and ERP systems, minimizing disruption to existing workflows.

5) Scalability and Global Reach:

-

InvoiceNow is an international framework adopted by multiple countries, allowing SMEs to expand their business networks beyond local boundaries.

-

By joining the InvoiceNow network, businesses gain access to a wider range of potential customers, suppliers, and partners across different countries.

6) Environmental Sustainability:

-

InvoiceNow aligns with sustainability goals by reducing paper usage and the environmental impact associated with traditional invoicing methods.

-

SMEs contribute to environmental conservation efforts and promote a more sustainable business environment with Peppol.

InvoiceNow FAQs

To find out more about InvoiceNow, please refer to the following list of frequently asked questions (FAQs) by IMDA that cover various aspects of this invoicing solution.

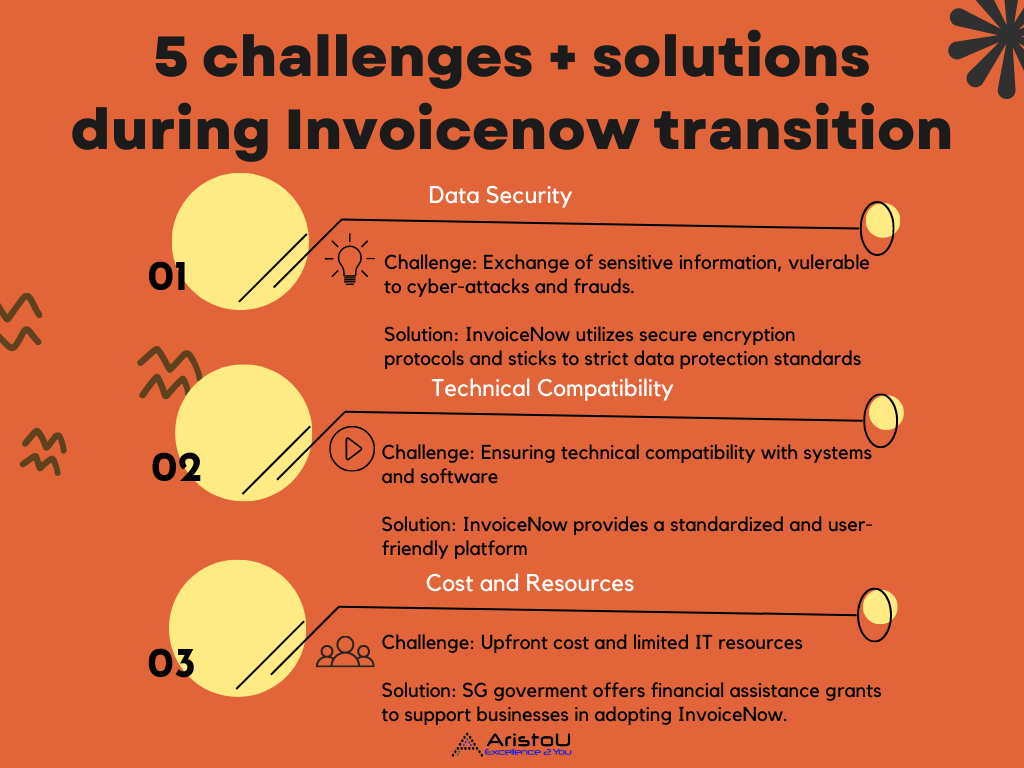

5 Challenges businesses might face when transitioning from Traditional to E-invoicing

Transitioning from traditional invoicing to e-invoicing can bring numerous benefits for businesses. However, there are challenges that businesses (especially SMEs) might encounter during this transition.

Let’s explore 5 challenges SMEs might face and how InvoiceNow can address them:

1) Data security

Challenge:

-

E-invoicing requires the exchange of sensitive financial information, which can be vulnerable to cyber-attacks and fraud.

-

Smaller businesses may be concerned about the security of their confidential financial information, and require having robust security measures in place when transitioning to e-invoicing.

Solution:

-

InvoiceNow utilizes secure encryption protocols and adheres to stringent data protection standards, ensuring the confidentiality and integrity of business data.

-

This provides a secure and trusted platform for exchanging invoices with authorized recipients.

2) Technical compatibility

Challenge:

-

E-invoicing requires businesses to have compatible systems and software to exchange invoices electronically.

-

Ensuring technical compatibility can be a challenge, especially for smaller businesses that may not have the financial capacity or limited IT resources to invest in new technology.

Solution:

-

InvoiceNow provides a standardized and user-friendly platform, making it easier for businesses to integrate with existing systems and ensuring compatibility across various software applications.

3) Cost and resources

Challenge:

-

Adopting e-invoicing may involve upfront costs, such as software licenses or IT infrastructure upgrades, which can be a concern for smaller businesses with limited budgets.

Solution:

-

InvoiceNow offers a cost-effective solution as it eliminates the need for paper-based processes, reduces manual labor, and minimizes errors.

The overall cost savings and efficiency gains can outweigh the initial investment.

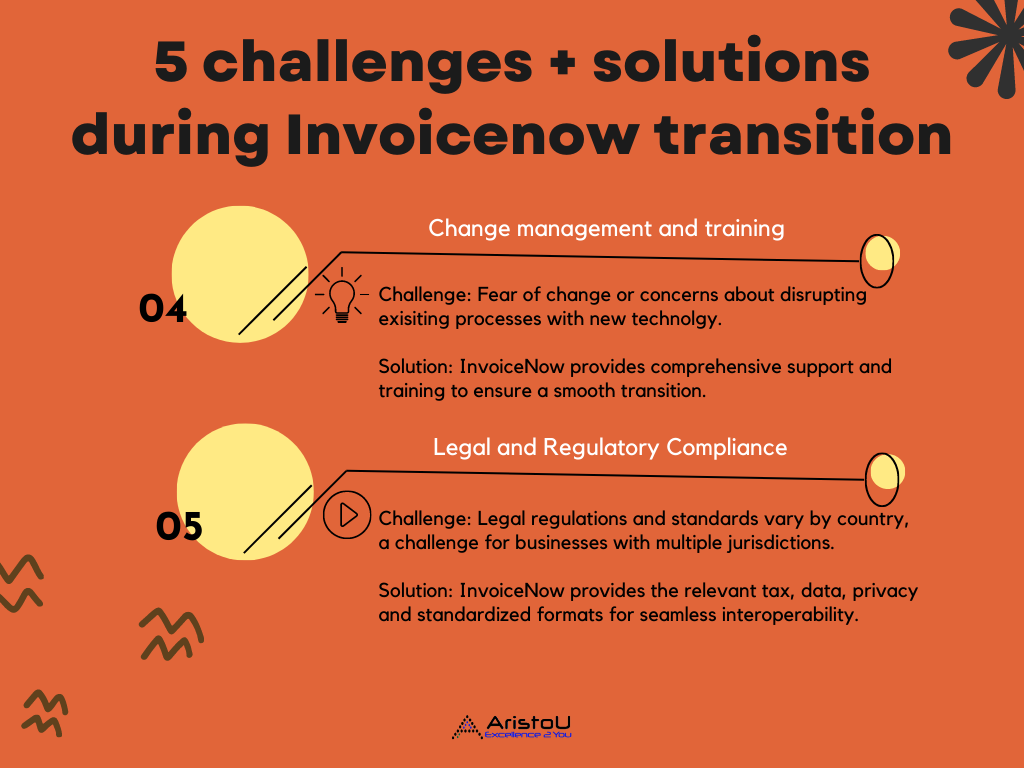

4) Change management and training

Challenge:

-

Some businesses may resist adopting e-invoicing due to a fear of change or concerns about disrupting established processes, the perceived complexities and costs that come with implementing new technology.

Solution:

-

InvoiceNow addresses this challenge by providing comprehensive support and training to ensure a smooth transition.

-

The user-friendly interface and simplified workflows make it easier for businesses to adapt to the new system.

5) Legal and regulatory compliance

Challenge:

-

E-invoicing legal regulations and standards vary by country, which can make it challenging for businesses operating in multiple jurisdictions to ensure compliance with all the relevant laws and regulations.

-

These include implementing electronic signature protocols, ensuring tax compliance, managing data retention and audit trail requirements, safeguarding data privacy, and achieving interoperability with industry standards.

Solution:

-

InvoiceNow provides built-in authentication, tax compliance features, secure data storage, privacy protection, and standardized formats for seamless interoperability.

-

Leveraging such platforms enables businesses to navigate the legal and regulatory landscape while streamlining their invoicing processes effectively.

Leave a Reply