All you need to know about Peppol E-Invoicing.

80% of workers go to office amidst lockdown to process invoices: A survey reported by Singapore Business Review. Does this stat sound familiar?

If you are a business owner with loads of invoices to prepare, send and receive, then you understand the time, money and manual labour required to process all these documents.

What if we told you there was a faster and more cost-effective way of handling such invoices?

Enter Peppol e-invoicing: Created to let your business seamlessly exchange e-documents or e-invoices electronically without human intervention.

Let’s dive further into Peppol E-invoicing below.

What is Peppol E-invoicing?

Peppol is an international E-Document delivery network and business document standard form of Electronic Data Interchange (EDI) allowing enterprises to digitally transact with other linked companies on the Network (IMDA 2022).

InvoiceNow enables direct transmission of invoices in structured digital format from one finance system to another by using the Nationwide E-delivery network. This is based on Peppol allowing for the invoice to be flipped to E-payments such as Paynow directly.

The traditional method vs Peppol framework:

-

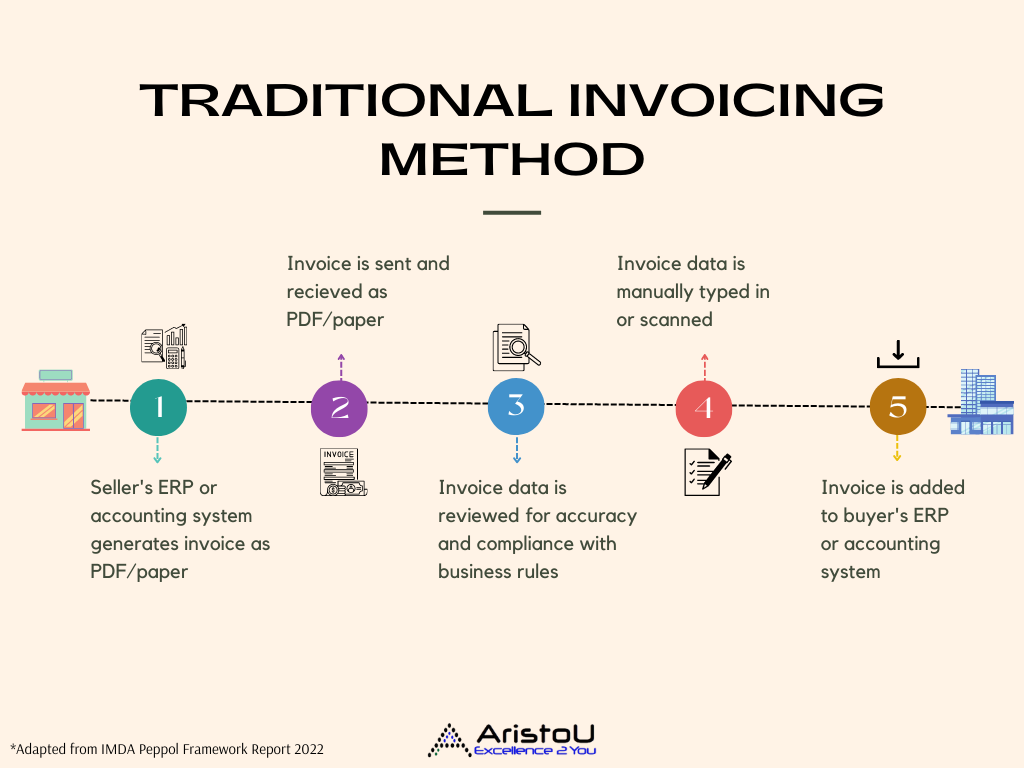

The Traditional Method:

Locally, the majority of sellers issue invoices by extracting the data from their accounting/ERP systems and formatting it in readable form and sending it to buyers via paper or email.

At the receiving end (buyer), manual labour is required to enter or scan the information into their systems which is a time-consuming and error-prone process.

Current PDF/paper based way of invoicing is tedious, error-prone and causes delay in payments.

-

The Peppol Framework: Nationwide E-Invoicing Network

To better understand the infrastructure of Peppol E-invoicing, we need to address the Nationwide E-invoicing Network in Singapore.

IMDA implemented the nationwide E-invoicing network in 2019 to help businesses improve efficiency, reduce cost, enjoy faster payment and stay green at the same time.

The Nationwide E-Invoicing Network adopts the Peppol framework which allows businesses to transact e-invoices internationally from one finance system to another without human intervention.

This speeds up invoice processing producing faster payment. It significantly reduces the time spent verifying invoices and chasing for payment.

How does Peppol E-invoicing work? (Step by Step)

-

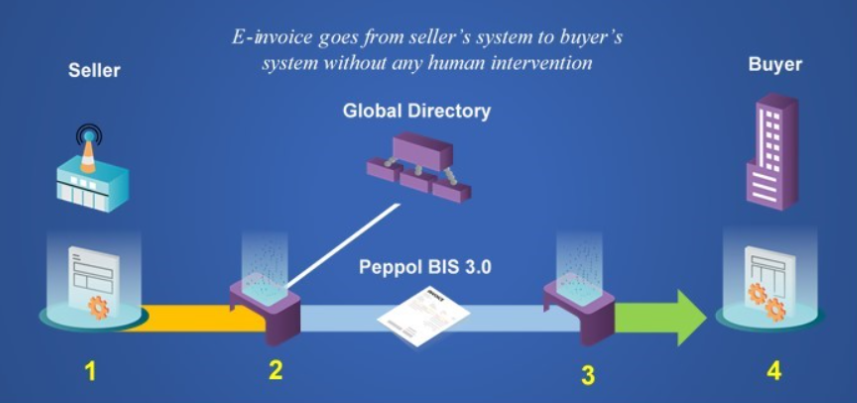

4 Corner-Model of Peppol Network

-

In the Peppol network, documents are exchanged using a common XML format known as the BIS (Business Interoperability Specifications) Billing 3.0 UBL.

-

This common standard allows users to choose their preferred accounting and ERP platforms, while being able to exchange invoices with their partners who may not be using the same platform.

-

Documents are exchanged through Access Points, which serve as gateways into the Peppol network.

-

Access Points take up the responsibility of mapping invoices of various formats into the standard format and send them to the receiving Access Points through the Peppol network.

Image source: IMDA website (2022)

In a transaction, the seller’s objective is to successfully send an invoice to the accounting/ERP system of the buyer without any human intervention.

Below is a snapshot of how the 4 corner model within Peppol Network works:

-

Documents that are sent out by the seller regardless of invoice format (corner 1)

-

They are converted into the common standard at its Access Point (corner 2).

-

The global directory provides necessary information to (corner 2) to identify the Receiving Access Point (corner 3) for the e-invoice to be sent through the network.

-

Upon receiving the e-invoice, (corner 3) will map the e-invoice into the preferred format of the buyer (corner 4).

This network allows the businesses to use the Accounting/ERP solution of their choice, connect once and connect to all.

What is different about Peppol E-invoicing? (USP)

In today’s business scenario, a PDF e-invoice is sent to the recipient organization by email. This is a single sided operation requiring your recipient to re enter the details of the invoice into their own accounting system (e.g. accounts payable).

A more complete solution should include the transmission of data from supplier system to buyer system without human intervention and potentially allow for the InvoiceNow invoice to be paid seamlessly.

It is noteworthy that InvoiceNow only covers business to business (B2B) transactions, B2C transactions are currently not available.

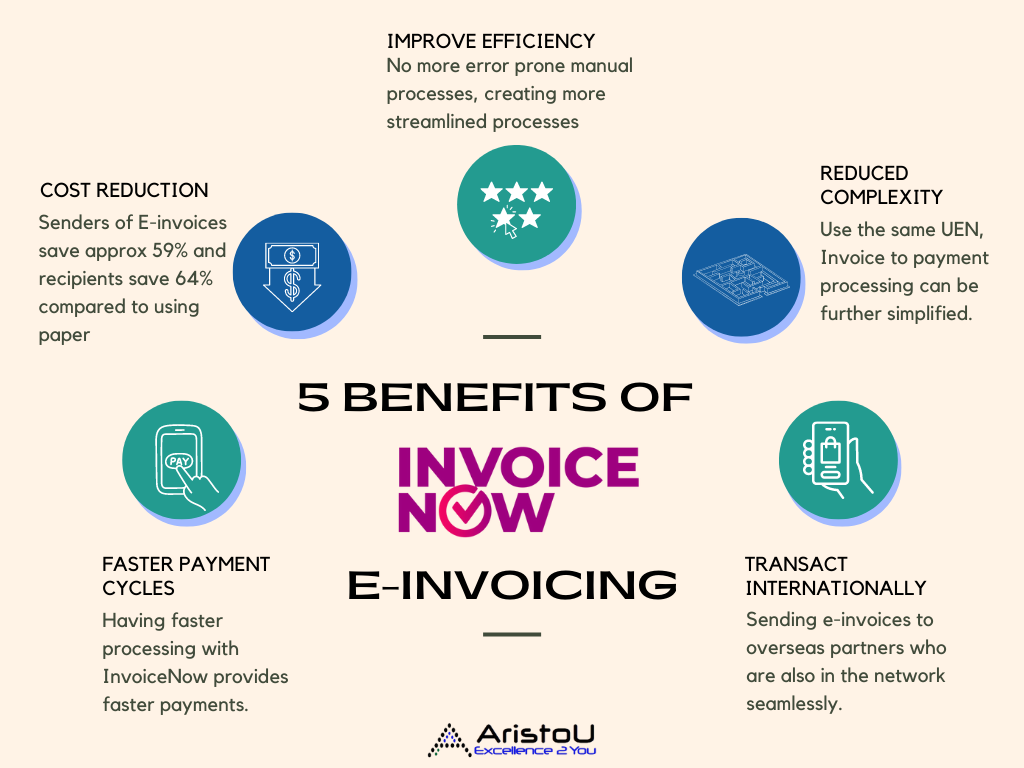

5 benefits for InvoiceNow e-invoicing

Below are 5 reasons why you should consider implementing InvoiceNow E-invoicing for your business, especially if you’re an SME or a larger enterprise.

1. Faster payment cycles

How InvoiceNow Invoices speeds up payment:

-

They are more efficiently being sent out in suppliers’ systems and then received, captured and processed more quickly at buyers’ systems. Having faster processing with InvoiceNow provides faster payments.

Delay in payment is a major concern of local SMEs (SPRING 2017 business survey). According to an article published by Mastercard (2019), e-invoices were 47% more likely to be paid on time compared to paper invoices.

2. Cost reduction

Research has shown that senders of e-invoices can save about 59% and recipients can save 64% compared to using paper based processes. Contributing cost factors could be storage and retrieval of hard copy invoices.

3. Improve efficiency

-

Paper/PDF invoices require staff on both sides to key the data into electronic systems which may result in human error. With E-invoicing, these error prone manual processes are completely avoided.

-

Businesses can skip labor intensive steps such as verifying information, rectifying errors and resolving conflicts.

-

Process are more streamlined

4. Reduced Complexity

Just like PayNow, InvoiceNow is also a UEN based E-invoicing. By using the same underlying UEN, Invoice to payment processing can be further simplified.

5. Transact Internationally

When other businesses are in the network, sending e-invoices to overseas partners is seamless.

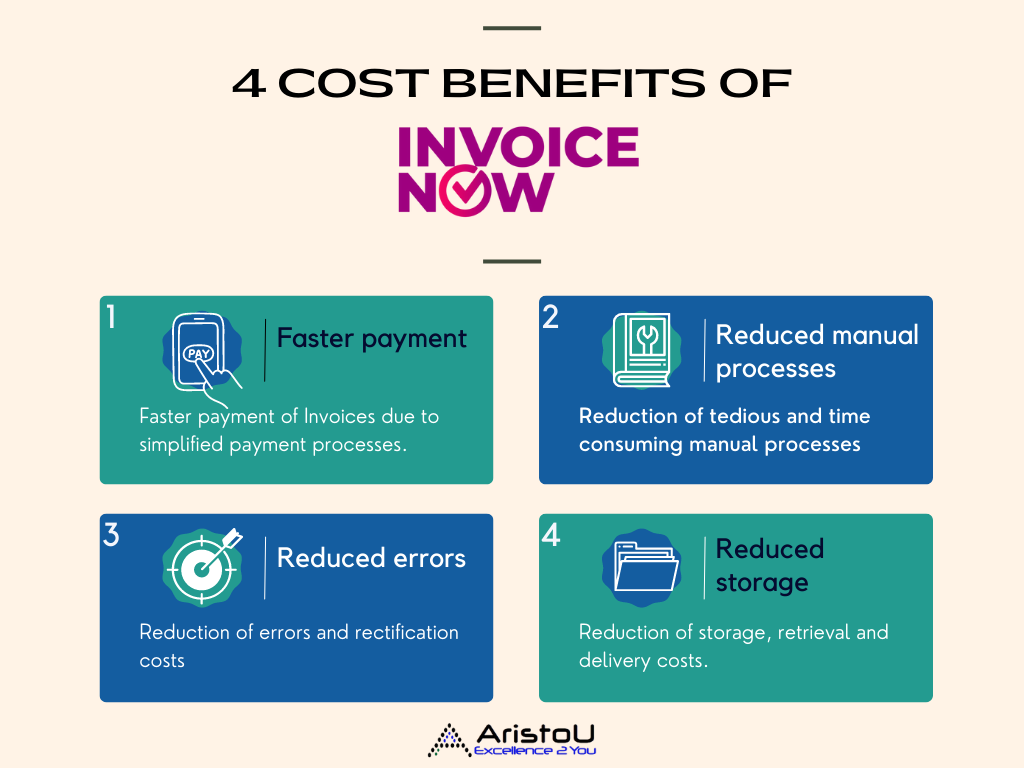

4 Cost Benefits to Organizations using InvoiceNow

How can InvoiceNow e-invoicing help save cost?

1. Faster payment of Invoices due to simplification of Invoice to Payment processes.

-

Several banks are working on solutions that allow users to directly flip an InvoiceNow e-invoice to an E Payment

2. Reduction of tedious and time consuming manual processes

-

Estimated $8 per invoice according to a study commissioned by IMDA (2022)

3. Reduction of errors and rectification costs

-

Estimated to affect 3% of paper invoices and costing as much as S$72 to rectify, according to a study commissioned by IMDA (2022)

Leave a Reply